The mention of payment services likely triggers positive feelings in many people since with it comes immediate thoughts about money. In Denmark, like the rest of the world money reigns high and convenience when making and receiving payments becomes a key priority. With the great progress in mobile telephony and internet, Denmark hasn’t dragged behind in embracing money movements over mobile phones.

With enough money in your bank account or just a functioning bank account in Denmark, it’s possible to send or receive mobile money payments. Perhaps this is one thing that sets apart the mobilepay system in Denmark from those used in other countries. In the Danish financial system, banks play a focal role in regulating transactions and reporting any suspected malicious activity. This means that mobilepay doesn’t operate as an exclusive standalone financial operator but only provides a convenient platform for routing money to and from bank accounts.

Denmark comes out boldly to stem any fraud and financial crimes which explains their insistence to constrain mobile payments to only provide a system for money transfers and not handling any monies. In short, the popular Mobilepay in Denmark does not have a separate account for holding customers’ monies but instead seamlessly links bank accounts through the simple to operate application on mobile phone. The Mobilepay application in Denmark developed by Nets Denmark A/S has become popular with residents for its convenience, affordable fees, and instant cross bank linkages.

Mobile money in Denmark

Anyone coming to Denmark for the first time will from time to time hear people talking about mobile payment. If nobody will have mentioned it to you within the first few days or arriving, know that it’s possible to send or receive money from or to your bank account over your smartphone. After opening a bank account, the next important thing to do in line with your finances is to download the mobilpay app.

As a newcomer in Denmark, you need to buy a lot of stuff and even pay bills. Ordinarily, people would pay for groceries, pay bus or train fare, check out products bought online or pay for meals at the city restaurant. All these transactions would require you to swipe your bank card or enter card details to authorize crediting of your bank account. With the mobilepay app, you only need to swipe and accept completion of payments.

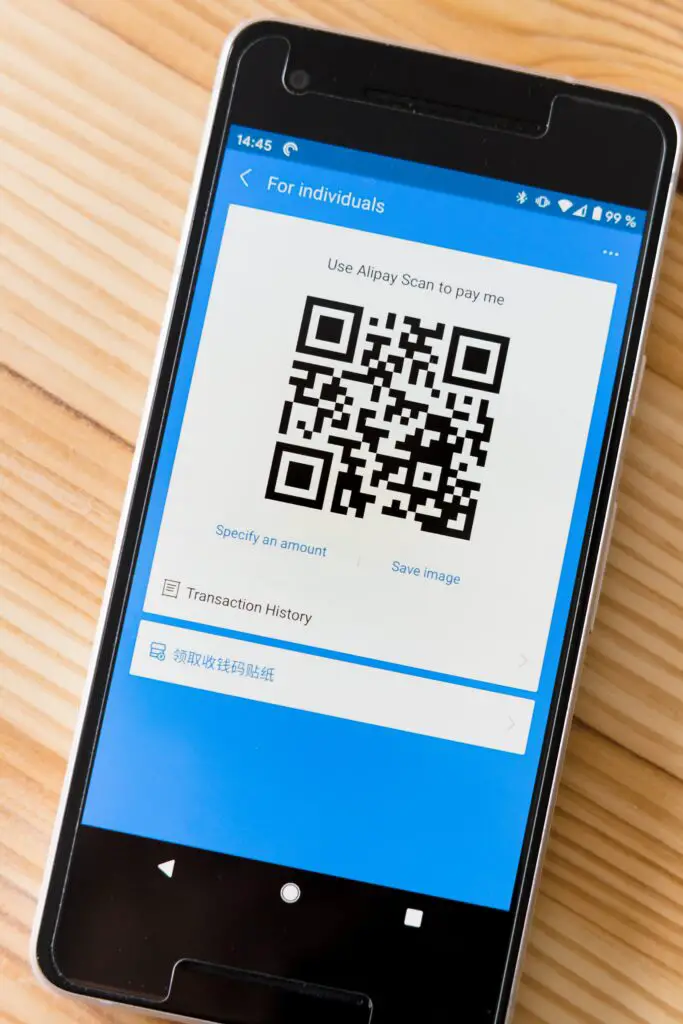

With the mobilepay system, you don’t have to scratch your head thinking of using the traditional methods of payments such as the credit cards or bank transfer. Fundamentally, mobile payment is just a simple but secure way to accept and make payments through a smart device such as your smartphone, or tablet. In fact, beyond your traditional cash or transactions using a card, the mobile payment will add a layer of security and convenience to transactions of the parties involved.

What is MobilePay that’s so popular in Denmark ?

Currently in Denmark, MobilePay is the most popular digital wallet. More than 5 million users are already using the service to make payments for their transactions. You do not want complexities or intermediaries when you are managing your transactions.

Regardless of where you come from, your love for small technological wonders in life should be evident. Because people value empowerment and freedom to act, exchange and share, the Mobilepay makes life simple for you as they found that such a feeling is universal.

As a financial solution, MobilePay will cover all your needs and these include your online payments as well. Here, you only need to swipe and pay with no need for your card or even bank account details. Recent reports have shown that the highest mobile payment transaction per capita among the Danes is attributed to MobilePay. As such, MobilePay has succeeded in empowering people across the Nordics to share life through joyful exchanges.

How to Use MobilePay

Using MobilePay is not as difficult as you may think. Ideally, if you want to pay with the app, you simply need to register your card(s) in the MobilePay app. Upon completion, you will be able to use MobilePay within apps, as well as on online shops.

Several factors must be considered when choosing Mobilepay as a payment method. As a customer, you will be needed to key in your mobile number after which the system will automatically redirect you to more MobilePay app features. Here, you will be needed to sign in with your pin code and subsequently confirm the payment with the swipe. The system will further prompt you back to the online shop for the order confirmation.

By enabling this payment method, the MobilePay app will be displayed along with other payment methods you offer. These may include Apple Pay or the card payments. Up to this stage, you are good to go! You can make and receive payments as you wish. You should not worry about the practicalities involved as the payment is set up by your gateway.

Why should you check out by Mobilepay?

Mobilepay is an extremely simple and hassle-free payment method. If you have one, you will not have to enter long card numbers. Interestingly, you also do not have to fetch your wallet to complete the purchase. Here, you only need your smartphone, which will always be right by your side wherever you go. Additionally, you will be required to have a Danish phone number. A Danish CPR-Number and bank account should also serve as enough evidence of residence in Denmark.

One must also be at least 13 years old to get a Mobilepay. Individuals conducting business are, however, permitted to have several accounts on Mobilepay but with a fee charged. The fee charged range from DKK 0.30 to 0.80 per transaction done via Mobilepay.

As a result, offering Mobilepay may increase merchants’ conversion rate. If you are planning to have the app in Finland, different requirements and charges may apply because of the different business legislation there.